If You Build It They Will Come, An Apama Algo Webinar

My colleague Dan Hubscher and I just finished the first of a two part Webinar entitled "Build Quickly, Run Fast".

In this Webinar we explained and demonstrated Apama as

an Algo platform for high frequency and order execution algorithms.

My colleague Dan Hubscher and I just finished the first of a two part Webinar entitled "Build Quickly, Run Fast".

In this Webinar we explained and demonstrated Apama as

an Algo platform for high frequency and order execution algorithms.

As I've blogged in the recent past it is an arms race in High Frequency trading. The need to build quickly is a demanding requirement to keep ahead in the race. Being armed with the right tools is paramount. Rapid development and customization of strategies using graphical modeling tools provides the leverage necessary to keep pace with fast moving markets.

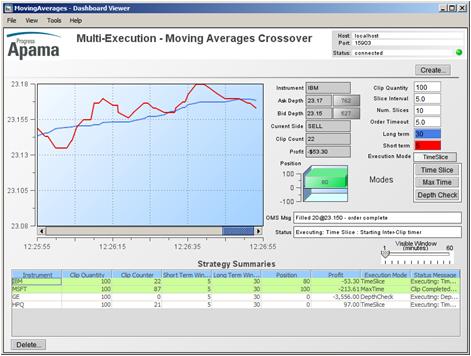

To that point, in this webinar I demonstrated a couple of algo examples. The first was a complete strategy that incorporates an alpha element with multiple order execution options. In designing and building strategies the trading signal detection is just the first part of the problem. This typically involves an analytic calculation over the incoming market data within some segment or window of time. For example a moving average calculation smooths out the peaks and valleys or the volatility of an instrument's price. Once the signal is detected it's time to trade and manage the order's executions. This is a key distinction between other CEP products and the Apama platform for building trading strategies. While it's possible to define an Event Flow in most or all CEP products for data enrichment and data analysis (i.e. the signal detection), for most other CEP products you have to switch out to some other environment & language to build the rules to manage the executions. The Apama platform is about building complete event-driven applications. So trade signal detection and order executions, whether it's a simple iceberg execution or something much more complex it can easily be designed, built and backtested in the same Apama graphical modeling environment (Of course for those more inclined to traditional development tools and methodologies, Apama offers a full suite of developer tools, an EPL, debugger, profiler and java support).

The second example in the Webinar demonstration was to build a small, but working strategy from scratch. I did this live in full view of the attendees. For this I did a basic price momentum strategy. This tracked the velocity of price movements. The trading signal was a parameterized threshold which indicated when that price moved up (or down) a specific amount for a specific duration.

This webinar is focused on highlighting the ever-present challenges investment firms face in high frequency trading:

- Fears of the Black Box

- The simple fact that markets are continually evolving

- First Mover Advantage

- Customization is king

Along with my colleague Dan Hubscher, the Build Quickly webinar describes how the Apama platform delivers solutions to the Capital Markets industry to meeting these needs and challenges.

Stay tuned for a link to the recording and don't forget to dial in to part II where we focus on performance requirements and characteristics. Again thanks for reading (plus watching the webinar), you can also follow me at twitter, here.

A follow up note, here's the link to the recordings for both part I and part II on Build Quickly Run Fast.

Louie